Artificial intelligence takes over your trading:

The Sentiment Trader Algorithm

Wrong decisions of the mass of highly emotional traders are mercilessly exploited by the Sentiment Trader algorithm - The profit is absurd

Over 90% of all traders are sooner or later victims of their own uncontrolled negative emotions: Greed, fear, ego, impatience, etc.

As long as people have emotions, this will not change.

Our artificial intelligence has no emotions and therefore knows no mercy. The Sentiment Trader algorithm looks for serious weaknesses of other market participants and therefore opens only trades with absurdly good risk/reward ratio.

The profits of the Sentiment Trader can therefore not be compared with conventional trading strategies and systems.

The Sentiment Trader Algo measures the market sentiment and knows at any time exactly how the masses are positioned in their tradings. Therefore, it also knows exactly where the masses make wrong decisions and we bet accordingly in the opposite direction.

This algorithm does not need complicated risk management, chart analysis and other analysis tools that interpret past values to draw conclusions for the future. Only current data is used to make signal decisions.

Each signal tells us that the masses are betting on the wrong direction in the market. This is the time when we make profits.

This is how we beat the market

More than 90% of market participants are too slow, too greedy, panic quickly and make fatal decisions sooner or later. Or they are simply not attentive enough, estimate the data situation wrongly, etc.

The Sentiment Trader algorithm recognizes exactly that and strikes when especially many traders make bad decisions at the same time.

This opens up trades with an enormously high risk/reward ratio for us.

But see for yourself:

Profits of the Sentiment Trader algorithm

Bitcoin

Bitcoin Backtest from Jan 1, 2016 to Aug 24, 2022 (long term test of 6 years):

Equity: 10,000 USD

Buy and hold return: +4,430.02 %

Buy and hold profit: +443,002 USD

Sentiment Trader return: +127,376.38 %

Sentiment Trader profit: +12,737,638 USD

Bitcoin Backtest from Apr 13, 2021 to Aug 24, 2022 (17 months since the start of the Bitcoin bear market in 2021):

Equity: 10,000 USD

Buy and hold return: -64.02 %

Buy and hold loss: -6,402 USD

Sentiment Trader return: +89.04 %

Sentiment Trader profit: +8,904 USD

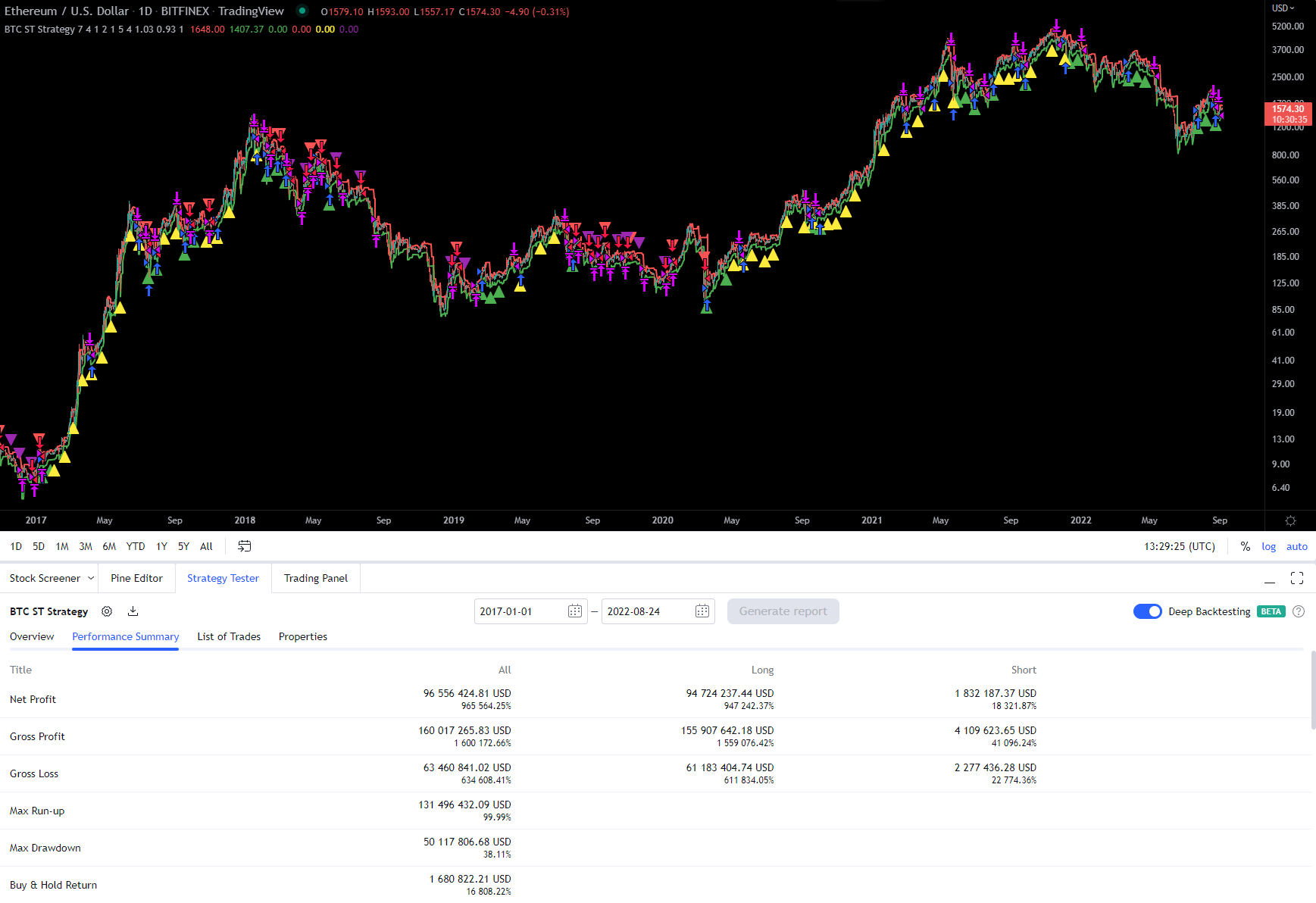

Ethereum

Ethereum Backtest from Jan 1, 2017 to Aug 24, 2022

Equity: 10,000 USD

Buy and hold return: +16,808.22 %

Buy and hold profit: +1,680,822 USD

Sentiment Trader return: +965,564.25 %

Sentiment Trader profit: +96,566,424 USD

Trading mistakes of the others,

that the Sentiment Trader exploits

Subjective perception of prices

Many traders dare to take a higher risk when a price feels "cheap" and stand on the sidelines as if ordered and not picked up when the trend is already pointing up and the price feels "expensive".

As always, 90% of market participants are wrong exactly then. The sentiment trader doesn't care about the price. If the masses get in just because the price feels psychologically favorable, a short signal is fired all the more and conversely a long signal is fired when the masses watch the trend run away.

Uncontrolled emotions

The human psyche is susceptible to uncontrolled emotions such as fear and greed, so the disposition effect will sooner or later cause traders to lose.

This means that traders often sell a position in profit too early and hold a position in loss too long.

Statistically, 40% of traders give up after just one month. After 5 years only 1% of traders are still profitable!

The losses of the 99% who are forced to give up within 5 years are profits in the pockets of informed professionals.

Our algorithm knows no emotions and secondly, it mercilessly exploits the disposition effect.

Price manipulation

Most traders do not understand how price manipulation works. Especially not how to protect themselves from it or even how to exploit it.

That is why they are hopelessly exposed to the shenanigans of the big players.

The sentiment trader does not manipulate prices, but is maximally well informed and knows exactly what moves the price at the moment.

The "Big Players" know exactly how uninformed traders are lured into the wrong direction by manipulations. The Sentiment Trader recognizes this and is programmed to fire a signal exactly when a manipulated movement is imminent.

Chart analysis predicts the future

If red comes up ten times in a row in roulette, most players would assume that black must now also come up once.

People interpret past values and draw conclusions about the future from them.

Chart technology works in a similar way. What lines and patterns show us is only something that has already happened. Masters of technical analysis therefore try to guess a price pattern before it becomes visible.

We spare ourselves error-prone interpretations of price patterns and rely on data close to the market in the present.

Don't waste time and get access now to

the Sentiment Trader:

Not convinced yet?

What active participants from Germany, Austria and Switzerland say about the Profit Scout algorithms:

Wolfgang says:

I've only been with you for three days. But the involved mindset of your existing video course Daniel (already partially twice) completely devoured has now already saved my savings just in time, lets me chilled observe the current situation and awakens the anticipation of "go shopping"!

Huge thanks for this!

Crypto Doc says:

Here an example: if you look in May last year, there was a buy signal at btc. So perfect hit to buy the altcoin again.

Arne says:

Thanks for the food for thought.

Solana habe ich nach einiger Recherche auch gekauft. And Ether I bought as well but a little bit too less.

Benedikt says:

Hey Daniel,

Thanks for the info. I'm already in the members area. I've been following you for a few years now (YT interviews; Telegram etc.). I think that you have the highest competence of all "Social Media's" in the crypto area and that you analyze and interpret the market in a realistic and well-founded way. Therefore great that you now offer such a great product, which is also still 100% in line with my investment thoughts.

I am looking forward to our time together.

Many greetings

Benedikt

Wolfgang says:

Wow, what a great adventure playground (with all seriousness of course!)! Since you Daniel really succeeded again a masterpiece with addictive factor

Alexander says:

I am very happy with the signals, last time bought BTC at 18.7k.

I have now watched all the Sentiment Trader videos and I feel just great about it! The mix of Profit Scout, Heatmap and Sentiment Trader is just perfect to increase your btc holdings in a relaxed way!

LuLu says:

I also used the "Altcoin Take Profit Scout" last night for QNT and sold.

I buy at the moment always small positions when the BTC dips. Also for different coins. Then the days after I check the coins all with the

Altcoin Take Profit Scout and if such a case occurs as with QNT I sell and buy later again after.

Are you ready for arguably the most profitable and intelligent crypto trading algorithm?

It is now up to you whether you want to achieve the financial goals you desire with crypto trading. You can continue to follow your strategies and hope to be statistically among the 1% that are profitable after 5 years, or follow a system that is proven to work in the long run and furthermore takes 95% of the work off your hands, or even 100% with our autotrading.

If you are not ready to make a decision today, I recommend you to save the website as a favorite and return as soon as you can make a decision.

Frequently asked questions (FAQ)

Is there a minimum term?

No. You can cancel at any time. The cancellation can be made informally in the form of an email, Telegram message or directly to CopeCart (our payment service provider). The cancellation must be made before the end of the selected payment period.

I have hardly any experience in trading cryptocurrencies. Can I still be successful with the "Profit Scout" system?

Yes, you will learn everything you need to know in our video course. It's streamlined and to the point, so you're protected from losses as quickly as possible and can apply the knowledge directly for profits.

I am a total beginner in trading. Is the "Sentiment Trader" nevertheless something for me?

Yes! Basically, you don't even have to understand why signals are fired. All you have to do is follow our signals. It is not necessary to make your own decisions about trading.

Is there a lot to learn before I get started?

We strive to convey information in as condensed a form as possible. With about 20 videos on average á 5 - 10 minutes, our video course is kept lean, so that the knowledge transport is effective.

Do the algos still work at all if they are used by many people?

What about the information advantage?

We only use data that is not subject to alpha decay. This data cannot be manipulated and gives us clear information about what market participants are currently doing at any point in time. It is irrelevant how many people look at this data. If the majority expects prices to rise, we sell and vice versa. As long as people have emotions, our strategy works.

Is there support?

Yes, you can always use our VIP Telegram group for your questions.

What is the difference between Profit Scout Algorithms and Sentiment Trader?

The Profit Scout algorithms are suitable for the optimal management of your investments in Bitcoin and Altcoins. Investment strategies differ from trading strategies in that positions tend to be held longer. For example, stop loss and take profit strategies of the longer-term time horizon are rather subordinate.

The Sentiment Trader is, as the name suggests, a trading strategy in which besides betting on rising prices (long positions), bets are also made on falling prices (short positions). Profits are realized in shorter periods of time and tight stop loss orders are set.

The Profit Scout algorithms are suitable for the more passive investor with little risk appetite. The Sentiment Trader increases risk for far greater profit prospects. They are simply two different strategies, but both are based on information advantage through data close to the market.

What is the difference between the "Trader" and "Trader Pro" packages?

The "Trader" package includes trading signals for long and short positions, as well as stop loss and take profits for Bitcoin in the daily chart.

The "Trader Pro" package additionally offers the possibility to have all Sentiment Trader signals traded by an automatic trading bot. This means that you do not have to actively do anything yourself. You also get additional signals for Ethereum (ETHUSD), as well as access to the TradingView indicator for the visual representation of the signals.

How does automatic trading work?

Auto-trading is completely under your control. You deposit money on a crypto exchange of your choice and link the account to the signals of our TradingView indicator. How the setup works is explained in detail as a video description within our members area. If you have any questions, you can use our VIP Telegram group.

Move to the winning side now:

You decide whether the Sentiment Trader algorithm recognizes your weaknesses in trading and bets against you, or whether you are on the other side.

Copyright © cryptoprofitscout.com

Disclaimer:

No investment and financial advice. The contents are for information purposes only.